Commodities trading is a massive global enterprise worth trillions of dollars. It involves the buying and selling of an expansive selection of financial instruments. These are broadly divided into hard commodities and soft commodities. These financial instruments are either extracted from the ground, or the oceans, grown, or produced.

Let's backtrack for a second: What are commodities? A commodity is essentially a raw material or a basic good that is used in commercial activity. In other words, people buy and sell commodities on a daily basis, as part of a more complex set of goods and services. We consume commodities, and they are used in production processes too.

One of the most important features of commodities is their fungibility. This means that they are freely exchangeable with one another, or with similar asset types. Silver, gold, platinum, crude oil, natural gas, wheat, barley, sorghum, and coffee are all fungible commodities. Such is the size and scope of commodities trading, that these markets are massive, highly liquid, and efficient.

What Are the Most Popular Traded Commodities?

The most-traded commodities can easily be bought and sold at the click of a button. Liquidity refers to the ease with which you can trade commodities. When there are scores of buyers and sellers present, a market is said to be highly liquid. It is against this backdrop that we can gauge the most actively traded commodities in global markets. According to the Futures Industry Association (FIA), the most traded commodities include the following:

- Gold

- Corn

- Sugar

- Coffee

- Cotton

- Silver

- Wheat

- Crude oil

- Natural Gas

The soft commodities are grown, sewn, and harvested. They include oats, corn, wheat, cocoa, coffee, cotton, sugar, rough rice, soybeans, et cetera. The hard commodities are extracted from the earth or the water, and include the likes of WTI crude oil, Brent crude oil, natural gas, propane, uranium, silver, gold, platinum, palladium, coal, and iron ore. Commodities are subdivided into metals, agricultural markets, and energy commodities.

Why Are Commodities So Important in the Global Economy?

It wouldn't be a stretch of the truth to say that the global economy is built on commodities trading. Without these precious resources, raw materials, and basic goods, there would be no factors of production, and no output capacity. It's the crude oil, natural gas, and petroleum products that powers the jet engines, ships, vehicles, machinery and equipment that we use to generate economic activity. Let's take a look at several actively traded commodities:

Brent Crude Oil – this crude oil is extracted from the North Sea and is a benchmark price for buying crude oil all over the world. It's a low-density oil, and it has low sulfur content.

WTI Crude Oil – this is West Texas Intermediate crude oil. It is extracted from the Texas basin, and it is considered one of the finest-quality crude oils in the world. It is easily refined into other petroleum products, and is a global benchmark. It typically trades at a lower price than Brent crude oil.

Natural Gas – as with crude oil, natural gas is non-renewable. It has many applications in the world, both consumer and business oriented, for heating, cooking, and electricity. Natural gas is also used in the manufacturing of commercial products, including organic chemicals and plastics. This hydrocarbon gas mixture is comprised largely of methane, and includes alkanes, helium, hydrogen sulfide, nitrogen, and carbon dioxide.

Soybeans – soybeans have widespread applications in the world, particularly with the feeding of livestock. They are also used in the creation of vegetable oil. As a popularly-traded commodity, soybeans are everywhere, including your favorite restaurant, coffee shop, and grocery store. The biggest soybean market in the world is the US, making up 50% + of global production. Soybean oil, and soybean meal are important spin-offs from the soybean market.

Gold – all that glitters is gold. This precious metal was responsible for the gold standard, and is widely regarded as a hedge against geopolitical uncertainty, market volatility, and other economic shocks. Gold is rare, valuable, and has many applications, ranging from jewelry and fashion to computing technology, medical devices, central bank reserves, et al. Gold’s value is derived from its malleability, ductility, rarity, and quasi-indestructibility (except for cyanide).

As you scroll through this list, you are probably remembering all the commodities you are familiar with. Now that you have a detailed understanding of the main commodities, we turn our attention to trading commodities. As a market leading authority in commodities trading, 8Invest is proud to bring you a wide range of commodity CFDs on our trading platforms.

Thanks to WebTrader, you can buy and sell commodities online on your laptop, desktop, iMac, MacBook, iPad, iPhone, Android smartphone, tablet, or phablet. Our powerful trading platform puts you in charge of your commodities trading activities.

What Commodities Are Available at 8Invest?

8Invest has been facilitating commodities trading for well over a decade, and our range of commodities includes the following:

- Gasoline

- Brent crude oil

- Cocoa

- Oil

- Soybean

- Natural Gas

- Heating Oil

- Cotton

- Copper

- Wheat

- Gold/USD

- Silver

- Coffee

- Sugar

- Palladium

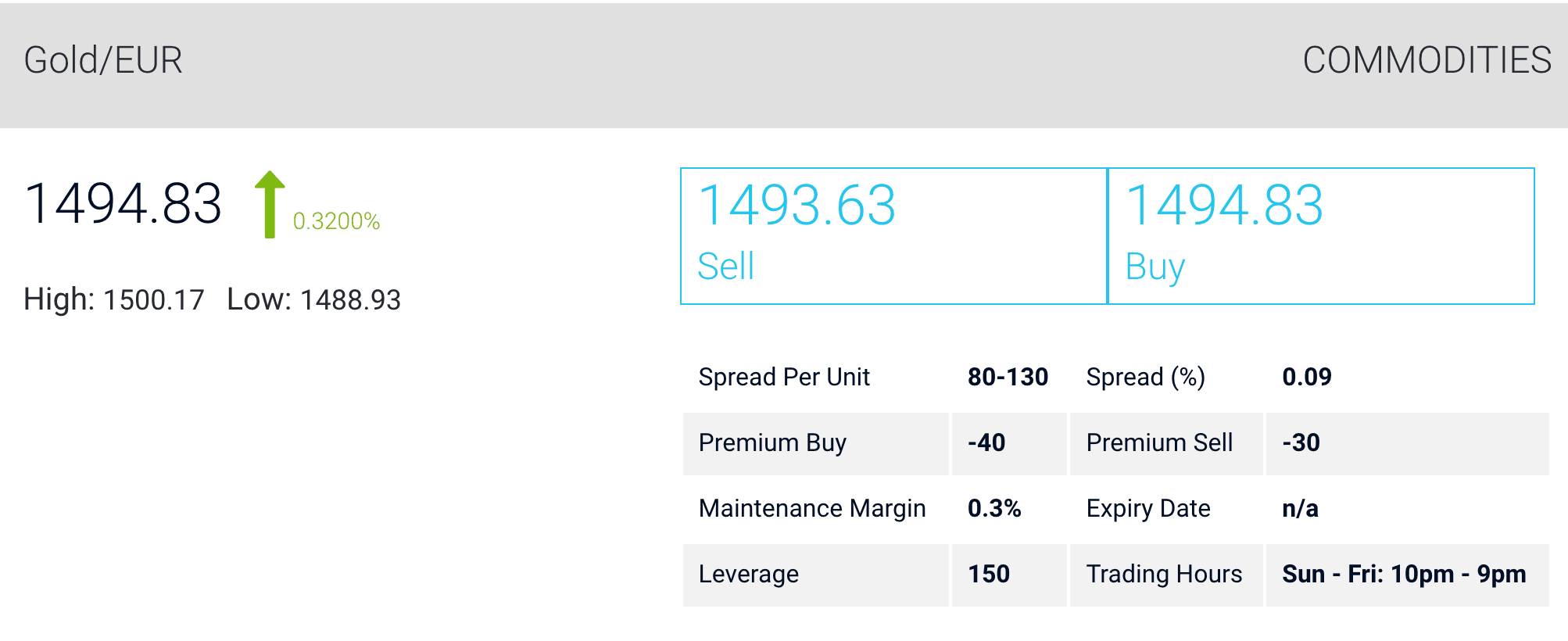

- Gold/EUR

You will notice that commodities CFDs are priced at the price of the underlying financial instrument a.k.a. the commodity itself. Our trading hours for commodities are listed from Sunday through Friday, for your convenience.

How to Trade CFD commodities?

When you trade CFD commodities, leverage is involved. This is important, since you don't have to lay out the full amount of the trade from your own capital*. For example, gold is leveraged at 150:1. This means that $1 gets you $150 of buying power at 8Invest. The margin requirement in this example is 1/150 = 0.67%. Put differently, you only need to provide 0.67% of the trade amount to open that position.

* Be advised that leverage can result in magnified profits or magnified losses, depending on the direction of asset price movement.

You simply need to specify whether you want to Buy or Sell the commodity. This requires a combination of technical and fundamental analysis. Consult charts, graphs, and macroeconomic variables to determine which way you believe the market is going to move. If your expectations of gold are bullish, then you go LONG on gold. That means you Buy the CFD. If your analysis leads you to believe that the price of gold will decline, you go SHORT on gold. That means you Sell the CFD.

The price you open the contract for and the price you close the contract at will be used to determine the size of your profit or loss. If your assessment is correct, you can profit from commodities CFD trading on rising or falling prices*. With fixed spreads and no commissions in place, 8Invest makes it incredibly attractive to trade commodity CFDs online.

* Be advised that leverage can result in magnified profits or magnified losses, depending on the direction of asset price movement.

At this point, you are probably wondering what you going to do with all that gold? With CFD trading, you don't actually purchase the underlying commodity – you're simply buying a contract which mirrors the price movements of the commodity. This is ideal for trading purposes, especially over the short-term.

Each and every actively-traded commodity is affected by supply and demand considerations. These are highly liquid markets which respond to push and pull factors. If the Federal Reserve Bank decides to raise interest rates, this will affect the price of gold. Rising interest rates are good for dollar demand, since it makes the USD inherently more attractive.

However, this will make gold more expensive to foreign buyers and drive down the price of gold. But here's the thing: when interest rates are rising, people want to take advantage of that by shifting their funds into higher interest-yielding investments. Gold doesn't pay interest. During the 1980s, gold rallied when interest rates rose, but gold also rallied when interest rates declined in the 2000s. It’s not always a linear correlation.

What are the Benefits of Commodity CFD Trading?

- 8Invest CFDs are much more cost-effective to trade than shares. We don't charge any commissions, and there are fixed spreads on our commodity CFDs. For our full fee schedule, kindly click here.

- 8Invest CFDs come with leverage. That means you use less of your own capital up front to open the trade*. Commodity CFD leverage is high, with 100:1, and 150:1 on different commodities. For details of commodities leverage, click here. * Be advised that leverage can result in magnified profits or magnified losses, depending on the direction of asset price movement.

- 8Invest CFDs can be traded in either direction – up or down. You don't need to wait for commodities to appreciate in value – they can also depreciate in value. Provided you call it correctly, you can finish in the money. Trading long and short positions is easily done at 8Invest.

- 8Invest CFDs are a great way to hedge against commodity investments. If you're currently holding commodities for investment purposes (buy and hold), and prices move against you, you can always take a short position on commodity CFDs.

- 8Invest CFDs allow you to diversify your portfolio. When you're only using a fraction of your available capital on any given trade, you can open up multiple trades and spread your risk all around. We offer CFDs in forex, commodities, indices, shares, ETFs, and bonds.

It sounds too good to be true, right? Whenever you’re using leverage there are always risks involved. Markets are unpredictable at the best of times. If a trade starts to move against you, you may be required to make a margin call (deposit more money to keep the position open).

With commodity CFDs, you are liable for the full value of the trade, not just the margin requirement that you deposited. Maintain sufficient capital in your account to cover your position if the trade moves against you. With commodity CFDs, you may be required to pay rollover fees if you keep your positions open overnight. As a rule, you want to limit your use of leverage to what you can afford.

Now you know exactly how commodity CFDs are traded at 8Invest. You can confidently register an account, deposit, and trade for real money. Put your newfound knowledge to the test on WebTrader and our mobile trading apps. The more you learn about commodity CFD trading, the more successful you will be.