Trade Government Bonds with 8Invest's Service

Government bonds are debt-based financial instruments. However, it's not debt that you incur – its government debt. The way government bonds work is as follows: the government needs money to fund big-ticket expenses like infrastructure growth and development, and other macroeconomic projects. It sells debt instruments to the public – bonds – and adds a premium for your benefit. This is the interest paid on the government bond. The interest rate is known ahead of time, making these a stable and safer investment option, albeit at a low yield.

Think of government bonds as loans to the government over the long-term. Depending on the government you are loaning your money to, government bonds are usually one of the safer investment options available. It is unlikely that the Federal Reserve Bank for example will default on its obligation to repay its loans. With government bonds, there is a coupon – that is the nomenclature for interest. This fixed-interest bearing financial instrument is a safe-haven option for investors. If you don't want to deal with the volatility of forex, cryptocurrency, commodities, indices, stocks, or ETFs, bonds are a safer alternative.

Once your bond matures (becomes due) in 1 year, 5 years, 10 years, 20 years, or 30 years +, you will receive your principal amount of money back + the accumulated annual coupons. As a case in point, consider Treasury bonds. These financial instruments make semi-annual fixed interest payments to bondholders. These debt instruments are exempt from state and local taxation, but you must pay federal taxation on the interest received. Recently, the US government began issuing 20-year bonds to take full advantage of the ultralow interest rates in the US. This helps the government borrow money cheaply now, before rates rise.

If you wish to trade U.S. Treasury bonds, there is an official exchange – TreasuryDirect.gov. It can be a complicated process that requires inputting personal information, and conducting in-depth analysis since it’s not clear which options are best, or how you can benefit from them. For example, there are Series EE Savings Bonds, and Series 1 Savings Bonds. Nowadays, all US government bonds are electronically issued – there are no more new paper bonds being sold. It is also possible to purchase these bonds through dealers, brokers, and banks, but you may not get the bond you opted for, or the value of the bond may be less than you anticipated.

What is the Bond Coupon Rate?

Recall that the coupon rate refers to the interest rate paid by the government to the bond holder. If the bond has a semi-annual coupon rate, it means that the full coupon rate for the year will be paid in two increments. As an example, if there is a 2% coupon rate, then a $1000 bond will pay $20 per year in interest, or $10 in two increments semi-annually. Clearly, these rates of interest are not very appealing when compared to the yield that can be generated with forex CFDs, commodity CFDs, stocks CFDs, or ETF CFDs. The benefit of buying and holding bonds as part of your investment portfolio is the stability that they provide. There is no way that the bond yield will be less than what you are offered as the coupon rate is fixed. Payments from TreasuryDirect.gov are made directly into your bank account.

In a topsy-turvy world where there is little certainty about the future yields, bonds provide a degree of stability. It's not a one size fits all policy with bonds either. There are different types of bonds for different countries. In the United States, bonds are known as treasuries. They have different expiry dates, with some expiring in under 1 year (T-bills), others expiring between 1-10 years (T-notes), and others expiring in more than 10 years. In the United Kingdom, bonds are known as gilts.

How Do I Trade Government Bonds?

Like any financial instrument, bonds can be bought and sold. Investors who already have bonds and would prefer to use that capital on more lucrative options typically sell their bonds at a discount. The buyer of the bond gets the full value of the bond (the principal) back at redemption + interest, so it is attractive for a buyer to buy discounted bond.

Naturally, the yield is more attractive to the new buyer because they're getting the bond for cheaper at the same fixed interest rate. Sometimes, bonds are traded at a premium where the new buyer pays more than the original buyer to get the same, fixed interest rate.

If all this sounds a little confusing, there is another option. You can trade bond CFDs at 8Invest. Our powerful trading platform – WebTrader - is readily available to registered traders on PC, Mac, and mobile devices. Bond CFDs are an entirely different option to a traditional bond. For one thing, the CFD is a derivative – it tracks the price of bonds in the markets.

You're not actually buying the bond which is going to mature at a later point in time, and paying the principal + interest. What you are buying is a contract that tracks the price movements of bonds in the markets.

Put differently, with bond CFDs you are speculating on the price movements (up or down) of the underlying financial instrument. In this case, it's the specific bond in question. At 8Invest.com we offer a wide range of popular bonds for you to speculate on. These include the following:

- US 5Y T-Note – the US 5-year Treasury note

- 10Y Euro Bund – the 10-year Euro Bund

- Gilt Long Government – the UK gilt long government bond

- US 10Y T-Note - the US 10-year Treasury note

- US 30Y T-Note – the US 30-year Treasury note

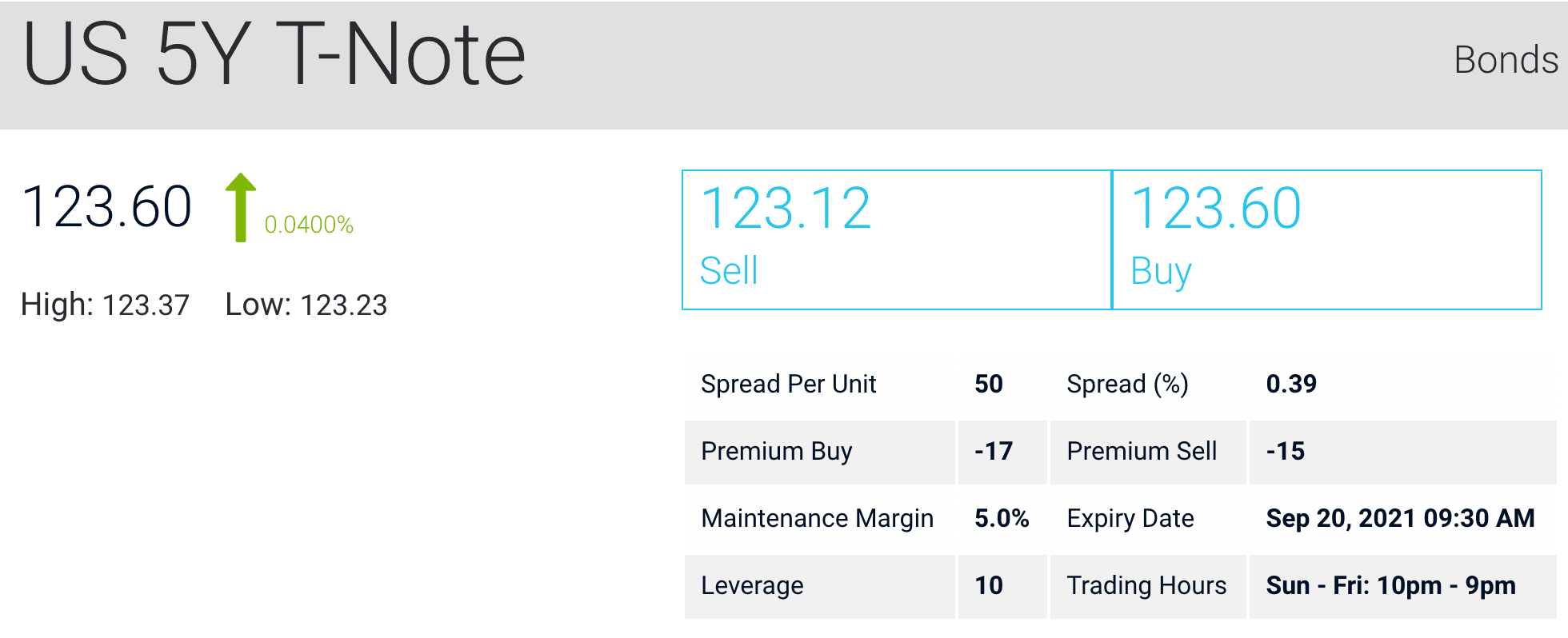

When you trade the US 5Y T-Note at 8Invest, you will notice several different elements at play. These include the spread per unit which is the difference between the buy price and the sell price, the spread percentage, the maintenance margin, and leverage. There are expiry dates associated with the 5Y T-Note, and all other bonds available through 8Invest. These present you with costs and a window within which to make a trade.

How Do You Trade Bond CFDs?

There are two ways to trade bonds – Buy or Sell. If you are optimistic about the future price of the bond, you would Go Long on the bond and buy it. This means you are bullish. If you are pessimistic about the future price of the bond, you would Go Short on the bond and sell it. This means you are bearish.

The degree to which your assessment proves true determines your profit or loss. Let’s assume that you purchase a bond, perhaps a US 5Y T-Note in the present in the expectation of price appreciation. If the future price of the bond is higher than the present price, the difference is your profit. This is a standard buy low sell high paradigm.

If on the other hand, you expect the future price of the bond to decrease, then you sell the bond now and buy it back at a cheaper price in the future, pocketing the profit. If the price does in fact decrease in the future, then you will finish the trade in the money with a bond CFD. If the price of the bond surprises you and moves in the opposite direction, you will be responsible for the difference. In other words, you will lose money on the trade.

It's worth pointing out that your profits or losses with bonds are not limited to the capital that you front for the trade. Leverage allows you to put down just 10% of the trade value to open the position. However, if the trade moves against you, you are responsible for the full amount of the bond, not simply the 10% that you invested.

Brokers may insist on a margin call if the trade starts to move against you. Capital will be required to keep the position open, failing which it will be closed out and your invested amount will be forfeited. FYI, it's easy to calculate your margin requirement if you're given a specific leverage value. In this case, 10:1 leverage = 1/10 margin requirement.

Why are CFD Bonds Available with Leverage?

Leverage multiplies the trading power of your capital. In the case of the US 5Y T-Note, leverage of 10:1 is available. This means that for every $1 of your money, you can trade $10 worth of US 5Y T-Note bonds. This also reduces by a multiple of 10 the capital you need to invest in any individual trade.

In a sense, it acts as an effective portfolio diversification strategy. It is extremely risky to concentrate too much of your capital in a handful of assets. By using leveraged trades, you can spread your capital into different financial instruments such as CFD forex, CFD shares, CFD indices, CFD ETFs, and CFD bonds.

When you speculate on the price movement of a bond, using leveraged trades, you are also allowing for the possibility of increased profits. While a minority of traders actually finish in the money with CFDs, careful and methodical planning using technical and fundamental analysis can improve your win/loss ratio. Speculation is challenging, particularly since financial markets have an uncanny ability to surprise even the most astute traders.

Are there Risk when Trading Bonds?

Even though bonds are backed by the government, there is always a degree of risk when trading bonds. For one thing, the price of everything goes up over time – that's known as inflation. When your initial investment – the face value of the bond is returned to you in the future, it will certainly not have the same buying power as it did when you paid for the bond.

The real issue is whether inflationary forces will eat into the interest, to nullify any gains that you have made. If you have to sell the bond before it matures, there is interest-rate risk at stake. That's why one CFD trading makes a lot more sense. It is a short-term option that eliminates the inflation risk and allows you to simply speculate on price movements to the upside or the downside.

One more important point to close up the topic of bond trading and interest rates. There is an inverse relationship between the price of a bond and the interest-rate. When interest rates are high, or rising, bond prices are low.

When interest rates are low, or falling, bond prices are high. Since the interest rate – the coupon rate - on a bond is fixed, falling interest rates will drive up demand for bonds. By the same token, fixed interest rates are less appealing when interest rates are rising, driving down the price of the bond!